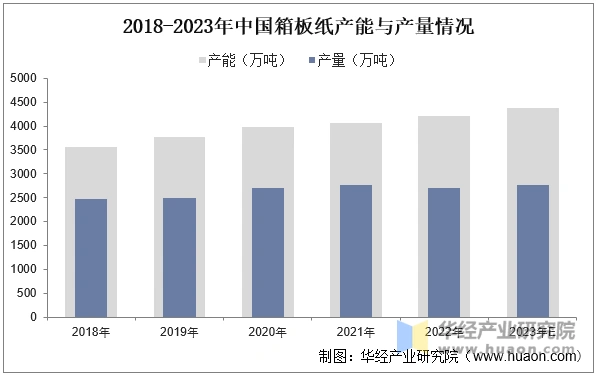

As the paper variety with the largest domestic production, the capacity of containerboard in China has been increasing from 2018 to 2022. In 2022, the supply of containerboard decreased slightly. The main reasons for the decrease in supply were the recovery of downstream demand that did not meet expectations, coupled with the fact that paper mills had a certain amount of inventory to reduce, and the paper mills stopped production for maintenance more often, which led to a decrease in the enthusiasm of paper mills for production. In 2022, the capacity of containerboard in China was 42.02 million tons, and the output was 26.923 million tons.

Source: Public information, Hua Jing Industry Research Institute.

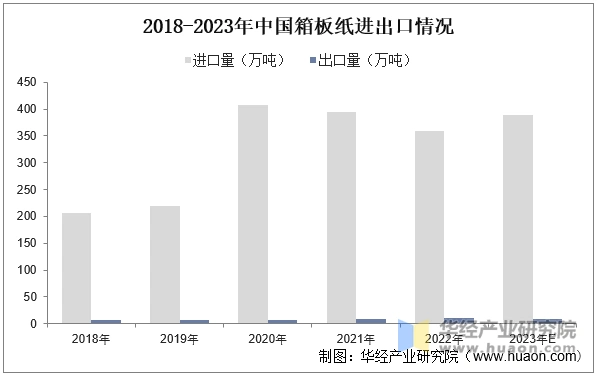

Looking at the historical import volume of our country, in 2020, with the clearance of solid waste, the domestic demand for imported long-fiber high-end boxboard and corrugated paper from overseas increased significantly. From 2021 to 2022, affected by the epidemic, consumption was under pressure and the price difference between domestic and foreign boxboard and corrugated paper gradually narrowed, and the import volume slightly decreased. According to statistics, in 2022, the import volume of boxboard paper in our country was 3.6 million tons, and the export volume was 110,000 tons.

Source: General Administration of Customs of China, Hua Jing Industry Research Institute, 2023.

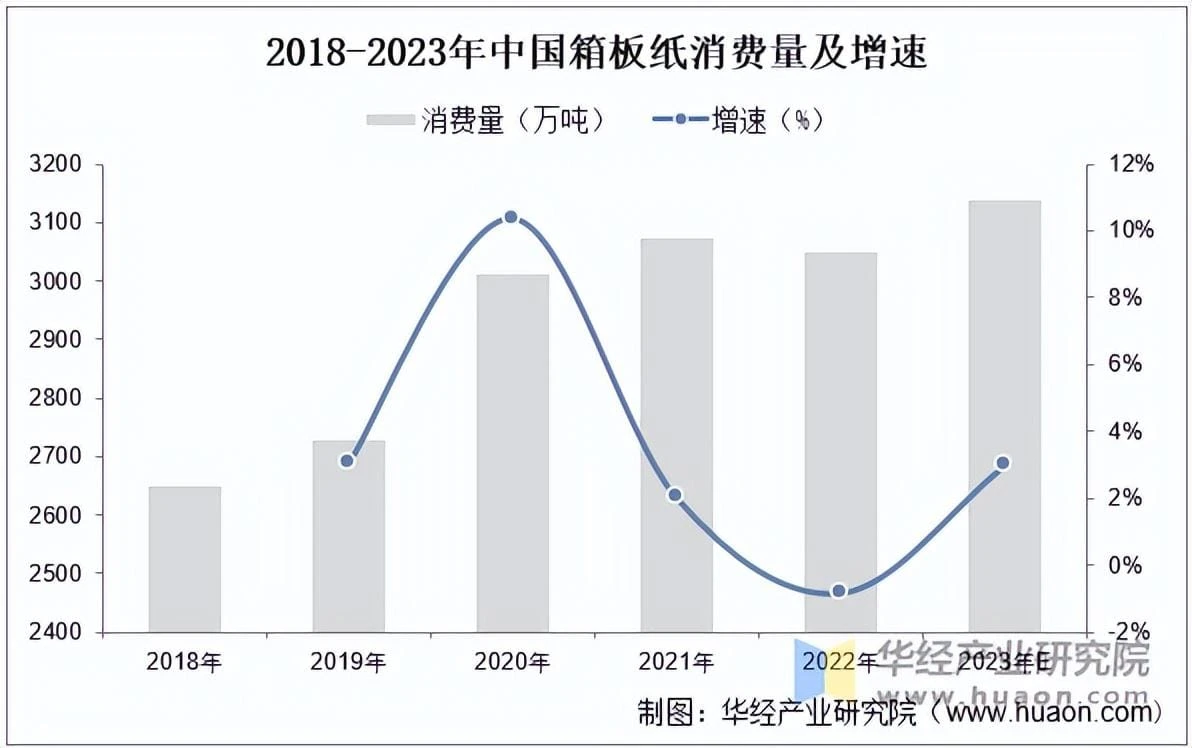

In terms of consumption, the domestic epidemic反复in 2022, the overseas entered the interest rate hike cycle, and the demand was under pressure. The domestic consumption of containerboard and corrugated paper entered negative growth. According to statistics, as of 2022, the consumption of containerboard and corrugated paper in China was 30.49 million tons. It is expected that by 2023, the consumption of containerboard and corrugated paper in China will increase to 31.40 million tons.

Source: Public information, Hua Jing Industry Research Institute.

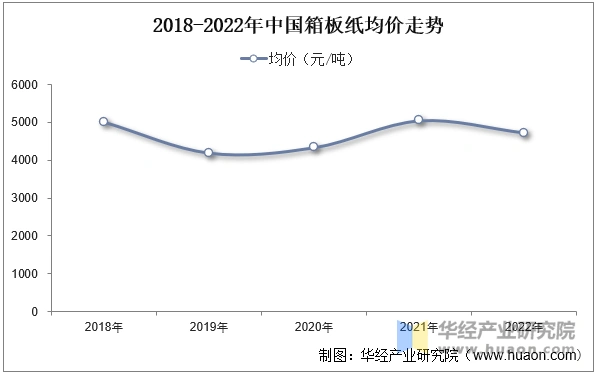

Domestic outbreaks in 2022, and overseas entered a cycle of interest rate hikes, leading to a prominent demand pressure. The corresponding containerboard price dropped from 4,897 yuan/ton at the beginning of 2022 to 4,425 yuan/ton at the end of 2022, a year-on-year decrease of 9.6%.

Source: Public information, Hua Jing Industry Research Institute.

This article is excerpted from the "2023 China Containerboard and Paperboard Industry Development Status and Prospect Forecast, the Dominant Enterprises' Influence Continues to Rise 'Chart'", released by the China Industry Research Institute. For the full text, you can enter the China Industry Research Network to search and view.

In 2022, China's total corrugated box plate production capacity was 76.66 million tons, a year-on-year increase of 4.6%. Among them, the production capacity of boxboard paper was 4.202 million tons, and the CR4 in 2022 was about 52.2%. The leading players include K令, Liwen, and Shanying, with market shares of 23%, 11%, and 14%, respectively.

Source: Public information, Hua Jing Industry Research Institute.

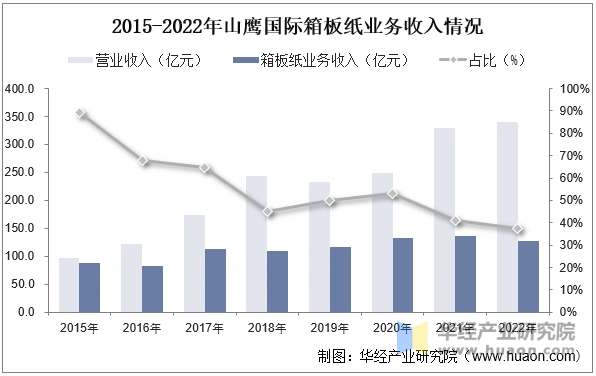

Shan Ying International Holdings Co., Ltd. is an international enterprise that integrates the comprehensive utilization of green resources, the production of industrial and special paper, the customization of packaging products, and the industrial Internet. The main business includes the production and sales of corrugated paper, containerboard, special paper, paperboard, and paper products packaging, as well as the trade business of recovered fiber at home and abroad. According to statistics, as of 2022, Shan Ying International's operating income was 34.01 billion yuan, of which the income from the corrugated paper business was 12.799 billion yuan, accounting for 37.63%.

Source: Company announcement, Hua Jing Industry Research Institute,

The research team of the China Industry Research Institute uses a combination of desktop research, quantitative surveys, qualitative analysis, and other methods to comprehensively and objectively analyze the overall market capacity, industrial chain, operating characteristics, profitability, and business models of the containerboard industry. Scientifically using research models and methods such as the SCP model, SWOT, PEST, regression analysis, and SPACE matrix to comprehensively analyze the market environment, industrial policies, competitive landscape, technological innovation, market risk, industry barriers, opportunities, and challenges of the containerboard industry. Based on the development trajectory and practical experience of the containerboard industry, we have carefully studied and compiled the "China Containerboard Industry Market Deep Research and Investment Strategy Planning Report 2024-2030", which provides important references for investment decision-making, strategic planning, and industry research for enterprises, scientific research, and investment institutions.

*REQUIRED FIELDS