Source: Zhuochuang Information

In November, the corrugated and containerboard market saw robust trading activity. Major paper mills successively announced price hike plans, prompting surrounding small and medium-sized mills to follow suit. Market transaction levels shifted upward, alleviating inventory pressure for mills and boosting production enthusiasm. Looking ahead to December, with multiple holidays including the Spring Festival and New Year's Day, the market may continue to rise driven by festive demand.

November Corrugated and Containerboard Market: Strong Trading Activity and Rising Average Prices

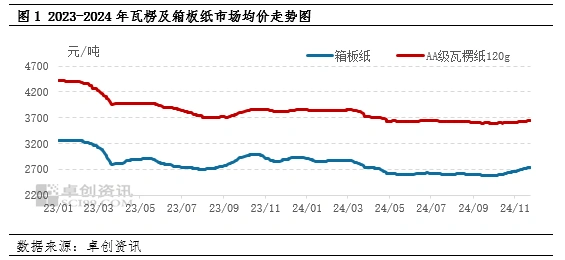

Market sentiment remained robust throughout November, with paper mills demonstrating strong pricing resolve. Major mills implemented 3-5 consecutive rounds of price hikes, prompting enthusiastic follow-through from surrounding small and medium-sized mills. Driven by a “buy on the rise, not on the dip” mentality and positive demand expectations, downstream buyers maintained decent purchasing activity. Mills achieved rapid shipment turnover, facilitating smooth implementation of price increases. According to data monitored by Zhuochuang Information, as of November 27, the monthly average price for AA-grade 120g corrugated paper in China reached 2,706 yuan/ton, up 3.13% from October's monthly average but down 6.04% year-on-year. The average price for containerboard stood at 3,629 yuan/ton, rising 0.67% month-on-month but declining 5.30% year-on-year, with the overall market trending upward.

Paper mills achieve significant inventory reduction with improved production enthusiasm

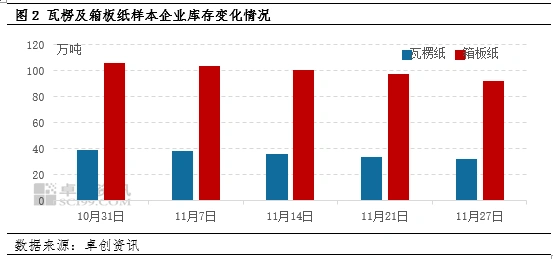

In November, downstream order intake remained relatively stable with positive expectations for future demand. Influenced by mills' strong price-hiking stance and buyers' preference for purchasing at rising prices, procurement enthusiasm remained decent. Changes in the demand side positively impacted paper mills, with improved shipment performance, increased product orders, and noticeable inventory reduction. According to data monitored by Zhuochuang Information, as of November 27, inventory levels at sampled enterprises in China's corrugated paper industry decreased by 24.90% month-on-month, while inventory at sampled enterprises in the containerboard industry decreased by 21.72% month-on-month. Production inventories have fallen to relatively low levels. The operating rate in the corrugated paper sector increased by 2.08 percentage points compared to October, while the operating rate in the containerboard sector rose by 3.05 percentage points over the same period.

Paper prices rise, restoring profits in corrugated paper sector

Market operations in November showed easing supply-demand tensions in the corrugated paper market, with overall price increases proceeding smoothly. Prices for waste yellow cardboard, a key raw material, rose concurrently but at a slower pace than corrugated paper prices, leading to a recovery in corporate profit margins. According to data monitored by Zhuochuang Information, as of November 27, the monthly average price of waste yellow cardboard in China reached 1,511 yuan per ton, a 3.00% increase from October's monthly average. The average gross profit margin for the corrugated paper industry in November was 8.55%, up 0.84 percentage points compared to October.

December Corrugated and Boxboard Market May See Upside Potential

From the supply side, the market's continuous upward trend in November has significantly reduced paper manufacturers' inventory levels, easing stock pressure. Multiple large-scale paper mills have announced December price hike plans, reflecting a strong stance on price increases, which positively impacts market sentiment.

On the demand side, December approaches the Spring Festival and New Year holidays. While traditional festive demand typically boosts expectations, downstream packaging plants have largely stockpiled base paper. Furthermore, price increases from paperboard manufacturers have not been fully passed on to downstream users, creating significant cost pressures.

Market sentiment remains positive as December falls within the peak consumption season for corrugated and containerboard paper. With the Spring Festival and New Year holidays approaching, industry players hold optimistic expectations for demand release. This bullish sentiment exerts a favorable influence on market price trends.

In summary, the corrugated and containerboard market in November saw robust trading activity, rising average prices, significant inventory reduction at paper mills, increased production enthusiasm, and improved profitability. Driven by the prevailing price-hike sentiment, the market may continue to rise in December. Key focus should be on the release of end-user demand and the effectiveness of price pass-through.

*REQUIRED FIELDS